1) INTRODUCTION:

François Doyon La Rochelle:

You’re listening to Capital Topics, episode #53!

This is a monthly podcast about passive asset management and financial and tax planning ideas for the long-term investor.

Your hosts for this podcast are James Parkyn and me François Doyon La Rochelle, both portfolio managers with PWL Capital.

In this episode, we will discuss the following points:

For our first topic, we will review and comment on the C.D. Howe Institute report on RRIF Mandatory Withdrawal Rules.

And next, for our main topic, we will tackle the debate regarding the classic 60/40 balanced portfolio.

Enjoy!

2) REVIEW OF THE C.D. HOWE REPORT ON RRIF MANDATORY WITHDRAWAL RULES :

François Doyon La Rochelle: In our first topic today, we will discuss a recent report from the C.D. Howe Institute that highlights the need to revamp the rules surrounding Registered Retirement Income Funds (RRIF) withdrawals because demographics and economic realities have changed since the rules were introduced. The report from C.D. Howe is entitled “Live Long and Prosper. Mandatory RRIF Drawdowns Raise the Risk of Outliving Tax-Deferred Saving”.

James Parkyn: This report from the C.D. Howe Institute comes at a time when many industry groups are being consulted regarding a study on RRIFs initiated by the Department of Finance. This study, on which the Department of Finance is expected to report back to the House of Commons sometime in June, will review whether the underlying assumptions regarding rates of return, inflation, and longevity continue to be appropriate.

François Doyon La Rochelle: Yes, and before we go into the details of the report let’s provide our listeners with a brief refresher on the mechanics surrounding mandatory RRIF withdrawals. When you have a Registered Retirement Savings Plan (RRSP) you must convert the account before December 31st in the year you turn age 71. You have 3 choices, the first choice is to convert to a RRIF, the second is to purchase an annuity and the third option is to withdraw all the funds as a lump sum, fully taxable, and close the account.

James Parkyn: Although you have the option to withdraw or buy an annuity, the vast majority of RRSP holders will convert to RRIFs.

François Doyon La Rochelle: Exactly and once, you have converted your RRSP to a RRIF you are required to make minimum annual withdrawals from it in the next calendar year after it was opened. This minimum amount to withdraw is set in the Federal Income Tax Act. The minimum annual withdrawal is calculated based on the fair market value of your RRIF on January 1st of each year which is then multiplied by a percentage factor based on your age. It’s important to understand that this percentage factor increases each year as you get older.

For example, suppose a client converted his RRSP to a RRIF in 2022 when he reached 71 years old and the market value of the RRIF on January 1st, 2023, was $1,000,000, then for 2023 this RRIF holder would have to withdraw a mandatory minimum of 5.4% of his RRIF therefore, he would need to withdraw $54,000. As mentioned before, this percentage factor increases annually as you get older to reach a maximum of 20% when you turn 95.

James Parkyn: Most people have saved and put money into their RRSPs during their working years and expect to draw a regular income from that pool of money during retirement but what’s at the heart of the discussion right now is the mandatory minimum RRIF withdrawal and the risk that these minimum withdrawals will deplete these savings too quickly.

François Doyon La Rochelle: You are right James in mentioning that. However, what the report highlights, and I will give our listeners some numbers later in the podcast, is that it’s the combination of the mandatory withdrawals and the fact that seniors live longer combined with the current lower real returns that are increasing the risk of seniors outliving their savings.

James Parkyn: François, I agree but on the other hand, it’s important however to mention that although you may be required to withdraw more money from your RRIF than you need, you can always reinvest the money withdrawn. In this case, if you don’t need all of it for your living expenses then you can reinvest in your taxable account or your TFSA if you have not maximized your contribution room.

François Doyon La Rochelle: You have a good point there James, Now, I think it’s important for our listeners to understand that the initial framework establishing minimum RRIF withdrawals dates back to 1978. There have been occasional changes since then, namely in 1992, 1996, 2007, and most recently in 2015. These small tweaks concerned either the age at which you had to convert your RRSP to RRIF or the withdrawal formula. The C.D. Howe Institute, in their report, proposes a major overhaul.

James Parkyn: I believe the federal government has realized the stress these mandatory minimum withdrawals put on senior’s savings. For example, in 2008 during the financial crisis and more recently during the COVID-19 crisis, they temporarily reduced the mandatory withdrawals by 25%.

François Doyon La Rochelle: I agree James, those measures were timely but did not address the fact that people live longer and the fact that real returns on safe assets are much lower now than in the past. C.D. Howe in their report demonstrates how the withdrawal rules interact with longevity and portfolio returns. To give you an idea of the interaction here is some data from the report for two scenarios. I will review and compare first the 1992 scenario versus the current scenario. In 1992, the report underlines that the real yield, not nominal, the real yield on a portfolio of the government of Canada bonds was 5.7%. The yield on the same bond portfolio today is a meager 0.6%. The impact of this yield decrease means that under the current rules, a 71-year-old of either sex would likely see the value of his/her RRIF decline by 50% by the time they reach age 84. In the 1992 scenario, based on the yield and longevity assumptions at that time, the value of his/her RRIF would fall by 50% by the time they reached 91. That’s a seven-year difference.

James Parkyn: This is a huge difference, but I’m not surprised. The change in real yield is enormous. We touched on that point in our last podcast #52 when we covered the Credit Suisse Global Investment Returns Yearbook, we highlighted then that the real return on the world bond index for the last 40 years was probably abnormally high at 6.3% especially when compared to world equities at 7.4% for the same period. The fact that real yields on safe assets are low is pushing seniors to have a larger weight in risky assets in their portfolio, making them more volatile and subject to losses at the same that they are taking out money. That’s a twofold blow to their pool of assets when that happens.

François Doyon La Rochelle: This large difference in real returns on safe assets speaks to the dwindling value of the portfolio over time but the other strong argument for change is longevity. Back in 1992 the odds of a 71-year-old man or woman reaching 91 years old, the year at which they would see their portfolio decrease to 50% of its original value, was 12% for men and 29% for women. Under the current scenario, a 71-year-old man has a 60% of chance and a 71-year-old woman has a 70% of chance reaching 84, the year at which they would see their portfolio decrease to 50% of its original value. This means a much higher risk of actually running out of money in the last years of their life.

James Parkyn: Francois, these numbers demonstrate the impact of lower portfolio returns on the sustainability of retirement savings. If people are living longer but their investment returns are lower, there is a higher risk of depleting their savings too quickly. It's crucial to address this issue and ensure the rules surrounding RRIF withdrawals reflect the current economic realities and demographic changes.

François Doyon La Rochelle: Another issue raised in the report concerns the Federal government’s impatience to collect taxes as quickly as possible rather than wait for voluntary withdrawals or the death of the RRIF holder to collect. The reports remind us that there is a limit to life expectancy but that, on the other hand, the government will be there forever and therefore guaranteed to collect. The report even goes on to say and I quote” the subsequent establishment of income-tested clawbacks of Old Age Security (OAS) benefits made that fiscal motive all the more compelling for the government”. This is another example of the government wishing to accelerate the collection of taxes.

James Parkyn: Indeed, François, I agree. With the mandatory minimum RRIF withdrawals, individuals may end up pulling more money from their portfolios than they need pushing them into a higher tax bracket, therefore, increasing tax revenues for the government. Additionally, the higher the mandatory withdrawals from the RRIF, the higher the probabilities that the OAS benefits may be clawed back, further impacting seniors’ retirement income. These aspects of financial planning and tax optimization are constantly at the forefront of our discussions with clients

François Doyon La Rochelle: Yes, and we do a lot of work, especially close to year-end, to tax-optimize portfolio withdrawals.

James Parkyn: So, Francois, what are C.D. Howe’s recommendations to help seniors?

François Doyon La Rochelle: The first pair of recommendations is to raise the initial age of withdrawal and the age at which the minimum withdrawals reach 20% annually. The third recommendation is to lower the required minimum withdrawal, they suggest that the withdrawals be reduced by 25% or even 30%. The C.D. Howe also recommends that there should be more regular reviews to consider changing yields on safe assets and change in longevity.

James Parkyn: The C.D. Howe report recommendations appear to be sound. However, any reform of the RRIF withdrawal rules will have to be a balance between the broader implications for both retirees and the government. The ultimate solution would address the risk of retirees outliving their savings while also considering the impact on government revenues and also on one of its largest expenses, the OAS.

François Doyon La Rochelle: Absolutely, and by striking the right balance, we can ensure retirees have a sustainable income and financial security in retirement while also addressing the government's concerns about tax revenues.

James Parkyn: We will see what the upcoming report from the Department of Finance offers to address these complex issues. But from my point of view, I think a more personalized and adaptable approach to RRIF withdrawals would help mitigate the risk of depleting savings too quickly and give seniors more flexibility and control over their finances.

François Doyon La Rochelle: I agree, it will be interesting to see how the government responds to these recommendations and what changes will be implemented to strike the right balance with the changing realities of retirement. We will make sure to follow up in another Podcast when and if changes are announced.

3) THE DEBATE ABOUT THE BALANCED PORTFOLIO OF 60% STOCKS & 40% BONDS :

François Doyon La Rochelle: So, for today’s main topic, we will tackle the current debate over the classic way of building a balanced portfolio which is an allocation of 60% stocks and 40% bonds. Our Listeners should know that some of the best-known names in asset management are taking opposite sides in the debate.

James Parkyn: This debate is very interesting for many reasons. Before we outline the opposing viewpoints, we should start with explaining the basics of a balanced portfolio for our Listeners. The foundational 60/40 portfolio, where 60% is invested in stocks and 40% in bonds, is the initial starting point for many portfolios. We go through a rigorous process to assess client’s profile and to come up with a long-term asset allocation recommendation. The balance of this 60/40 mix is then adjusted based on an investor’s time horizon, risk tolerance, risk capacity and their financial goals. But the stock-bond combination is core to what is considered a “diversified” balanced portfolio with Bonds considered the “Safe” component and Stocks the “Risky or Volatile” component.

François Doyon La Rochelle: I would add that generally, the 60/40 portfolio is expected to provide diversification because when Stocks have been down, Bonds have generally increased in value. That didn’t happen during 2022, largely because of high inflation created in the aftermath of the global Coronavirus pandemic. The resulting interest rate hikes by Central Bankers sent prices for Bonds falling. A 60/40 portfolio for U.S. investors had one of its worst years ever because the Bonds didn’t do what they would normally have done in the prior 40 years.

James Parkyn: And as our regular Listeners know, we have covered the topic of how rare the combination of both Stocks and Bonds dropping has been. I also recommend one of my recent Blogs titled “THE SILVER LINING FROM A TOUGH YEAR IN THE MARKETS IS HIGHER EXPECTED RETURNS”. The Title is the message: “Last year was an example of short-term returns coming in far below long-term expectations for both the stock and bond markets. Both asset classes fell by double-digit percentages for one of the few times in history. So, it is normal for Investors to question the soundness of the 60/40 Portfolio Model. This is a friendly reminder for our Listeners to beware of the Recency Bias effect. We have also addressed this in our recent Podcasts.

François Doyon La Rochelle: Exactly right. 2022 was painful for investors, but the silver lining is that those market declines improved long-term expected returns, especially for bonds. Our colleague Raymond Kerzerho stated on our Podcast # 50 on Expected Returns: “Higher bond yields in 2022 produced a remarkable increase in our estimate for expected bond returns going forward. It climbed to 4.15% a year from 2.5% the previous year.”

James, you have been calling this a “Normalization” of Interest rates as compared to the Pandemic Central Bank engineered ultra-low rates.

James Parkyn: Francois, I think it would be helpful if our Listeners get a little history of “Why a 60/40 Portfolio has been so popular for so long?” My answer is that it provided a solid return with a modest amount of risk and the Bond returns were the magic sauce component.

François Doyon La Rochelle: I agree James. The 40-year bull market in Bonds that ended in 2021 is a big part of the explanation. There was a recent Morningstar Investment Conference in Chicago where one speaker noted that the trend that made the 60/40 portfolio successful for so long was declining interest rates. He cited for example, in the case of American-based investors, the Barclays Aggregate Bond index returned 7.75% annually over the 40 years ending 2021. The result was that investors were able to receive 87% of the return they would have received if just investing in shares, but with 45% lower volatility. The protection offered by bonds didn’t come at the cost of sacrificing returns.

James Parkyn: The 60/40 portfolio did the things that investors wanted: a great return with modest risk. But as we discussed in our Podcast #38, the 2022 Credit Suisse Yearbook highlighted that the negative correlations between Stocks and Bonds were not the long-term norm. The 2023 Yearbook also reiterated that Stocks and Bonds have a historically positive correlation and that the last 20 years of negative correlation before 2022, were not the norm.

François Doyon La Rochelle: So, is it fair to say James that Bonds will continue to act as a Stabilizer in a Portfolio helping to hedge against the higher volatility of Stocks?

James Parkyn: Great question because what you believe to be the answer is where the debate about the 60/40 Portfolio starts.

François Doyon La Rochelle: In my view, in the 60/40 portfolio allocation, Bonds provide three very significant benefits: 1) Lower volatility, 2) An annual income stream, and 3) and most importantly, the return of your principal. But not all Bonds meet this standard so Investors must be very careful when building out this component of their Portfolio.

James Parkyn: So here are the battle lines in the debate: On one side you have the believers that the Balanced mix still makes sense as a starting point for many investors. On the other side, you have money managers who believe that alternative investments such as hedge funds, commodities, private equity, and inflation-protected assets can provide additional diversity beyond Stocks and Bonds. In effect, the latter group is saying “We don’t trust stocks and bonds completely to do the job of providing income, growth, inflation protection, and downside protection anymore.”

François Doyon La Rochelle: So, James who is on which side of the debate?

James Parkyn: Well, we have some of the biggest names in the global business of asset management. On one side you have Vanguard and Goldman Sachs. On the other you have BlackRock.

François Doyon La Rochelle: Why don’t you start with Vanguard. What are they saying?

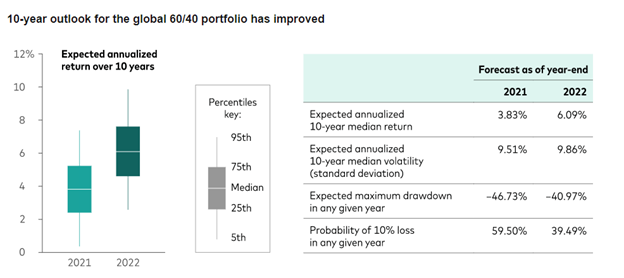

James Parkyn: Vanguard believes in the 60/40 Portfolio. Ziqi Tan, a Vanguard investment strategist in a recent Report stated: “With these more favorable valuations, Vanguard’s modeling shows that the return outlook and the worst-case risk scenario for the 60/40 portfolio have notably improved.” These improved valuations came as a result of the 2022 negative market returns. Vanguard produced a Chart that shows the range of expected annualized returns over the next 10 years for a global 60/40 portfolio as of year-end 2022 versus 2021. Expected returns have improved, with less downside risk.

Let me give our Listeners some of Vanguard’s data points:

François Doyon La Rochelle: So, what is Goldman Sachs saying?

James Parkyn: Goldman is arguing that the odd big loss like in 2022 is inevitable in any strategy and that 60/40 remains a valid basic approach. Goldman calculates that U.S. stocks and bonds both lost money over 12 months just 2% of the time since 1926. The Goldman thinking is “You might reasonably be upset that your investments were caught up in such an unusual loss, but you should make radical portfolio changes only if you think this is the start of something new.”

François Doyon La Rochelle: I think what they are saying is to beware of the Recency Bias. Recency bias is the tendency to overweight recent events/trends, projecting them into the future while ignoring long-term evidence. Now for the other side of the debate in the 60/40 strategy is BlackRock, the world’s largest investment manager. What are they saying?

James Parkyn: According to Vivek Paul, head of Portfolio Research at the BlackRock Investment Institute in a report stated: “This is a different regime. The great moderation is over. A focus on any one asset allocation mix misses the point: A regime of higher volatility with sticky inflation needs a new approach to building tactical and structural portfolios.”

BlackRock goes on to state “…the losses—the worst in nominal terms for a 60/40 portfolio since the financial crisis of 2008-9 and the worst in real terms in a calendar year since the Great Depression—show that the structure is outdated. The success of the 60/40 portfolio may have come to an end, with the basic math of the situation being unforgiving.”

François Doyon La Rochelle: We should address the debate through the lens of Capital Markets History. After 10-year Treasury yields peaked at 15.8% in 1981, they fell for four decades to a low of 0.5% in 2020, offering long-term capital gains to bondholders on top of the guaranteed income. Better still, from 2000 onward, stocks tended to rise when bond yields went up and fell when yields fell.

James Parkyn: But the situation is very different today than in the early 1980s. For example, 10-year yields can’t drop more than 15 percentage points in the next 40 years, because they currently yield only about 3.5%.

François Doyon La Rochelle: What I understand from BlackRock is that “It’s reasonable to think that higher rates might last given the long-term upward pressure on inflation from deglobalization, demographics, and spending to combat climate changes.”

James Parkyn: BlackRock highlights some Capital Markets history to make their case focusing on “What we can learn from 1969.” They state “In the mid-1960s, as prices rose, the Fed belatedly shifted into inflation-fighting mode by rapidly raising interest rates. The move eventually led to an economic recession and a period of negative returns for stocks and bonds. Bonds were able to provide a hedge to equities eventually, but only after the Fed had sufficiently snuffed out inflation.”

François Doyon La Rochelle: The key lesson according to BlackRock is:” Bonds may be a reliable diversifier when economic growth is slowing – but not necessarily when inflation is increasing. Why? Because when stocks decline due to rising inflation concerns, the Fed may simultaneously have to raise interest rates to slow inflation. In the end, bonds may lose out as well, potentially exacerbating losses in a diversified 60/40 portfolio.”

James Parkyn: To me, your viewpoint on inflation dictates which side of the debate you will agree with. If you feel that we’re probably heading for a more inflationary future, it makes sense to hold less in the way of ordinary bonds. But if you aren’t sure 60/40 Portfolio is a decent place to start.

François Doyon La Rochelle: A further argument for the classic 60/40 Portfolio is that many of the things put forward as an alternative portfolio cushion to bonds also had a terrible year last year. You might think U.S. Treasury inflation-protected Bonds would protect against inflation. This did not happen. Rising real yields meant that since the start of last year, U.S. TIPS have lost almost the same amount as ordinary Treasury Bonds.

James Parkyn: Same story for Private markets that are not marked to market. Being private could mean the fund manager doesn’t tell you that you’ve lost money, but the value of a loan or a company has gone down as interest rates have risen, no matter whether the company is private or listed. And fees are far higher. To me, most of the strategies proposed to “tweak” the classic 60/40 Portfolio are simply not evidence based and are highly influenced by the Recency Bias.

François Doyon La Rochelle: Agreed. Those Investors who strongly believe that the 60/40 Portfolio’s recent gains are merely a mirage, should consider swapping their bonds for cash. James, our Listeners may want to know, since Rates have, as you say “normalized”, how has the Expected Return on a 60/40 Portfolio changed?

James Parkyn: Taking the positive view that the 60/40 approach is still valid, Todd Schlanger, a senior investment strategist at Vanguard told The Wall Street Journal that he expects the next 10 years will see the 60/40 portfolio continuing to work. He estimates that the annualized 10-year median return for a diversified 60/40 approach will come in at 5.4%.

François Doyon La Rochelle: In the PWL 2023 Financial Planning Assumptions Report, the classic Balanced allocation of 60% Stocks and 40% Bonds has an Expected Return of 5.81% for a Market Cap Weighted Portfolio.

James Parkyn: The PWL and Vanguard Expected Returns are in the same ballpark. I recommend our Listeners go back to our Podcast #50 when we tackled Expected Returns.

Now let’s tie all of this together for our Listeners.

In 2022, Bonds did not play their traditional role of stabilizer acting to offset the negative volatility in Stocks. The 60/40 portfolio floundered in 2022, just as it periodically floundered during the 1970s and early 1980s. But this has been very unusual based on Capital Market History over many decades.

Your outlook on Inflation will be an important consideration for how you build the Bond Allocation of your Portfolio. Raymond Kerzerho of PWL in our Podcast #50 highlighted that now that inflation is back, we’re in a new economic environment. If you feel Inflation is sticky, then if your goal is to reduce the volatility of your portfolio, his advice is to stick with short term bonds. Our regular Listeners know, we have always positioned the Bond Strategic Allocation in short term Bonds.

And finally, my view Francois is that with valuations back in the range of reasonable for both Stocks and Bonds, a 60/40 Portfolio asset mix is an appropriate starting point.

François Doyon La Rochelle: That is a very important point you make. We have consistently maintained the discipline of being short duration and high quality with our Bond Allocation. This served us well in 2022. What we know from Capital market history is, Balanced portfolios flourish when interest rates fall, and the economy is sound. They also perform acceptably during recessions. But they cannot withstand inflation shocks that lead to sharply rising rates. Assuming the Central Banks can keep inflation under control, a Balanced Portfolio will profit investors who stay the course.

James Parkyn: Larry Swedroe in a recent Article about Recency Bias says it well; “Resisting recency bias is the key to earning the premiums available from all risky assets. That’s because of all the behavioral biases investors must overcome, with recency among the most powerful. It’s tempting to sell out of an investment that has suffered losses because it’s easy to think losses will keep happening. Because premiums adjust on an annual basis, investors need to have a long horizon to realize the true economics of the asset class.

François Doyon La Rochelle: To conclude James, our discipline, as our regular Listeners know well is to invest with “The Investor Mindset, focused on the long term”. We don’t want to be led astray by short-term noise in the financial media and recent financial market volatility. This challenge is daunting and applies to all Investors including us Professionals. We have said it often on our Podcast: “It is simple to say but not easy to do: We must always be cognizant that we can fall into a trap of trying to “Forecast the Future”.

4) CONCLUSION:

François Doyon La Rochelle: Thank you, James Parkyn for sharing your expertise and your knowledge.

James Parkyn: You are welcome, Francois.

François Doyon La Rochelle: That’s it for episode #53 of Capital Topics! Do not forget, if you would like to submit questions or suggestions for the show, please email us at:capitaltopics@pwlcapital.com

Also, if you like our podcast, please share it when with family and friends and if you have not subscribed to it, please do.

Again, thank you for tuning in and please join us for our next episode to be released on July 6th.

See you soon!